Corporate & Investment Banking – Structuring

ethical financing for

infrastructure.

GS Bank’s Corporate & Investment Banking division specializes in structuring ethical and sustainable financing for large-scale infrastructure, industrial, and energy projects aligned with national economic priorities. With a focus on transparency, responsible banking, and innovation, GS Bank partners with corporations and public institutions to support long-term growth, industrial transformation, and energy security.

Our dedicated experts ensure every project is guided by sound financial strategies, environmental responsibility, and governance standards, accelerating national development while fostering a resilient economic ecosystem.

Corporate & Investment Banking Process

With a focus on transparency, responsible banking, and innovation, GS Bank partners with corporations and public institutions to support long-term growth, industrial transformation, and energy security.

-

Project evaluation

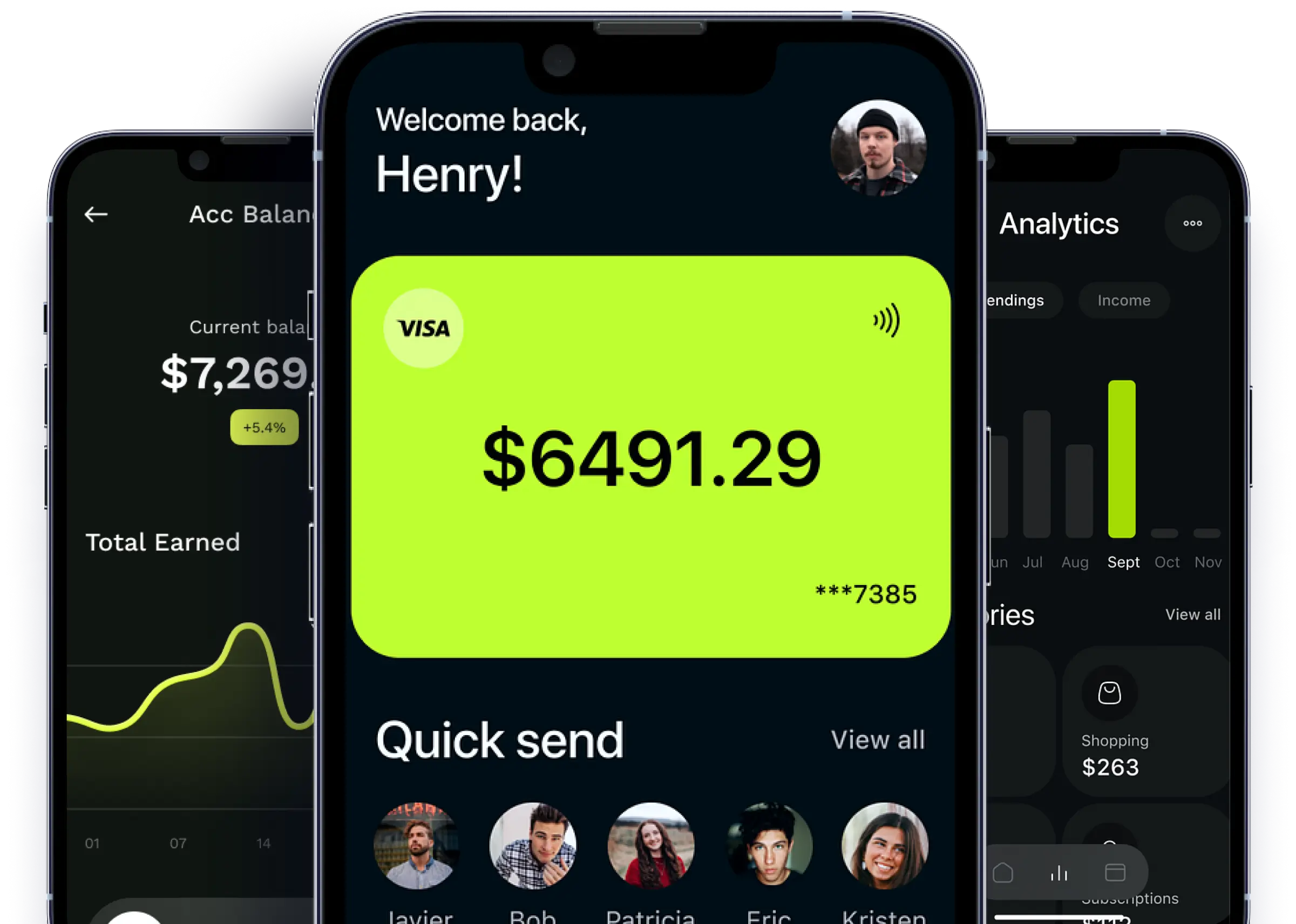

User registers online with biometric or e-signature authentication.

-

Ethical/structured

Customer receives a verified digital account instantly — no paperwork.

-

Risk assessment & approval

Users access savings, payments,and transaction history in real time.

-

Capital deployment and execution

Users access savings, payments, transfers, and transaction history in real time.

Corporate & Investment Banking outcome

Here are six key points that can be associated with a digital Transformation Risk Management Solutions. leader helping Fortune 500 companies on their innovation agenda:

-

Sustainable and responsible

-

Increased national capacity

-

Transparent and ethical financial ecosystem

-

investors, and society

-

Long-term value creation for economy

-

Strengthened public-private partnerships