Licensing & Compliance

Licensing &

Compliance

Trusted. Regulated. Responsible Banking.

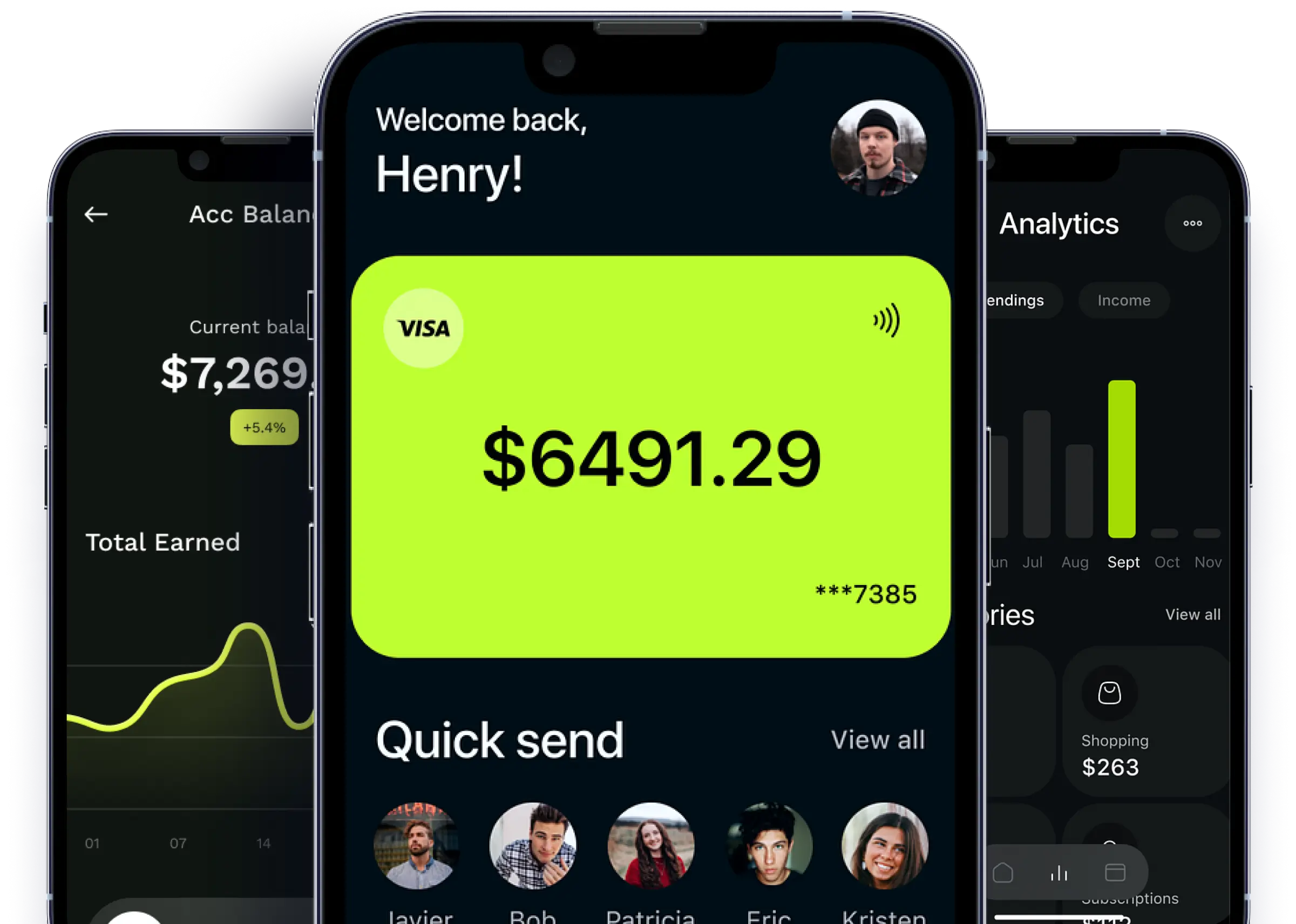

Who are gs-bank?

introduction GS-Bank S.A.

(Green Success Bank)

- GS-Bank operates with full regulatory supervision and strict compliance standards to ensure secure, transparent, and ethical banking services. As a digital and paperless financial institution, we follow national banking regulations, global compliance frameworks, and international best practices to protect customers, partners, and stakeholders.

- Our legal foundation is built on accountability, transparency, and trust.

Bank of the Republic of Burundi (BRB)

- The central banking authority responsible for licensing, supervision, and financial sector governance in Burundi.

We maintain continuous cooperation with.

- BRB regulatory compliance departments

- National financial intelligence & audit bodies

- Financial policy & digital governance authorities

Licensing Status

Institutional Identity:

GS-BANK S.A. (Green Success Bank)

GS-BANK S.A. (Green Success Bank)

Jurisdiction:

Bujumbura, Republic of Burundi

Bujumbura, Republic of Burundi

Regulatory Phase:

Institutional coordination & compliance development

stage, aligned

with national banking regulations and formal licensing procedures.

Institutional coordination & compliance development

stage, aligned

with national banking regulations and formal licensing procedures.

compliance COMMITMENT

We maintain Compliance Commitment

- Banking regulations & supervisory protocols.

- Anti-Money Laundering (AML) standards

- Counter-Terrorist Financing (CFT) rules

- Customer Due Diligence (CDD) & Know-Your-Customer (KYC)

- GDPR-aligned data-protection & digital privacy standards

- ISO-aligned cybersecurity & operational security controls

risk managements

Risk Management &

Governance

- Independent compliance oversight

- Risk assessment & monitoring systems

- Anti-fraud & cyber-security enforcement

- Ethical finance & transparent reporting

- Board-level supervision and internal policy committees

Authorised Department