Insurance & Risk Management – Providing accessible

insurance

solutions for farmers, cooperatives

GS Bank’s Insurance & Risk Management division offers accessible and affordable coverage solutions tailored for farmers, cooperatives, and small enterprises. We aim to protect livelihoods against unforeseen risks such as crop loss, livestock damage, natural disasters, or business interruptions.

Through simple digital enrollment, advisory support, and claim assistance, GS Bank empowers rural and cooperative communities to secure their financial future, ensuring stability, resilience, and sustainable growth across the agriculture and small-business sector.

Insurance & Risk Management Banking Process

With a focus on transparency, responsible banking, and innovation, GS Bank partners with corporations and public institutions to support long-term growth, industrial transformation, and energy security.

-

Eligibility assessment & onboarding

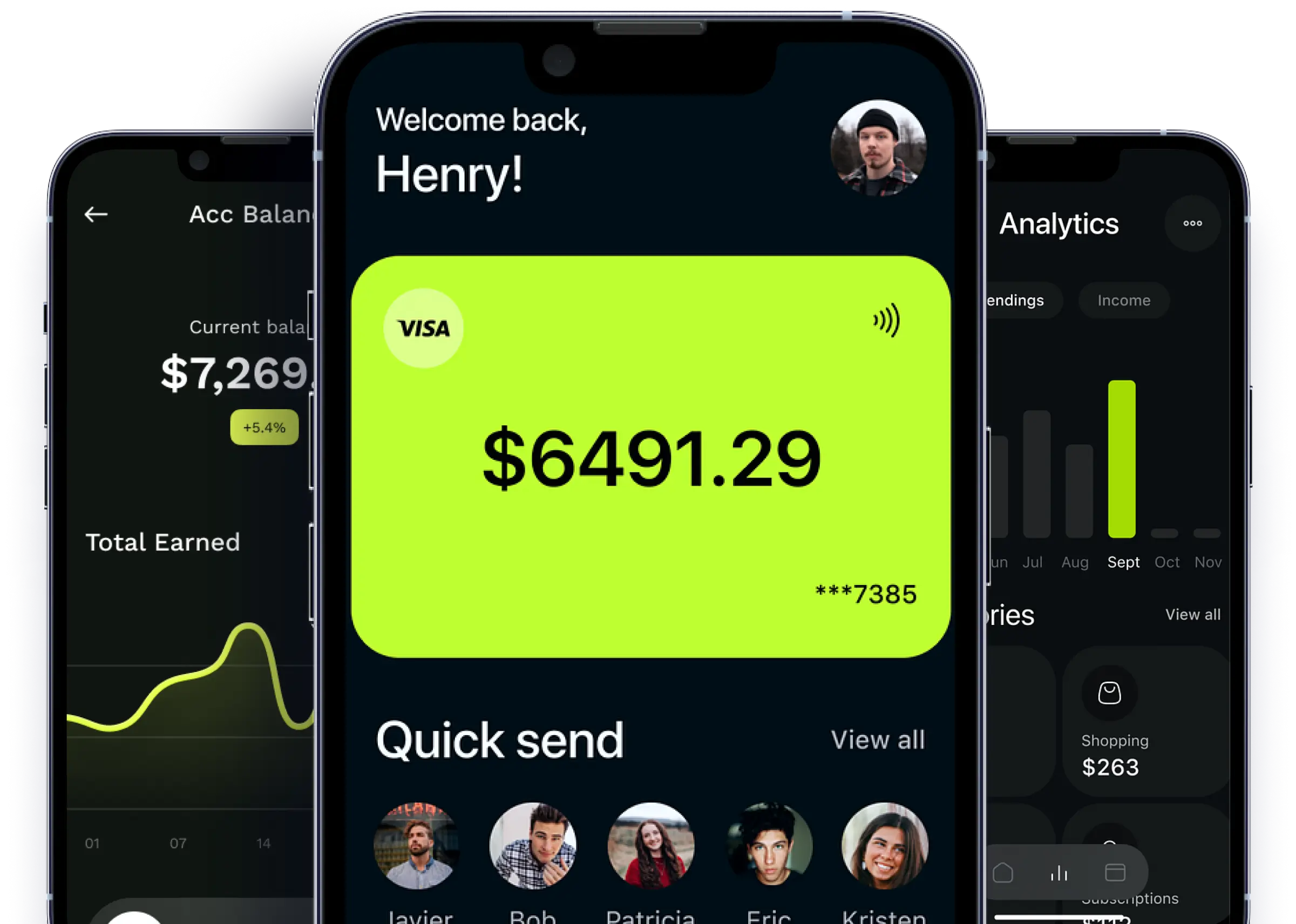

User registers online with biometric or e-signature authentication.

-

Risk evaluation & policy

Customer receives a verified digital account instantly — no paperwork.

-

Premium payment and policy

Users access savings, payments,and transaction history in real time.

-

Financial literacy training

Users access savings, payments, transfers, and transaction history in real time.

Insurance & Risk Management Banking outcome

Here are six key points that can be associated with a digital Transformation Risk Management Solutions. leader helping Fortune 500 companies on their innovation agenda:

-

Financial protection for farmers

-

Faster recovery and business

-

insurance services

-

Reduced vulnerability to crop failure

-

Increased trust in formal financial systems

-

Stronger, more resilient rural and cooperative economy