SME & Cooperative Banking – Financing

for small enterprises.

GS Bank’s SME & Cooperative Banking division provides tailored financing solutions for small enterprises, cooperatives, and farmers, combining digital loan applications with expert advisory programs. The service empowers entrepreneurs and cooperative members to access timely credit,

Plan their growth efficiently, and enhance their operational capabilities. By leveraging technology and personalized guidance, GS Bank ensures financial inclusion and sustainable development for small-scale businesses and agricultural initiatives.

SME & Cooperative Banking Process

GS-Bank empowers people with simple, ethical, and technology-driven financial services — anytime, anywhere. This is banking built for trust, speed, and financial empowerment across Africa’s digital future.

-

Submit loan applications

User registers online with biometric or e-signature authentication.

-

Evaluates creditworthiness

Customer receives a verified digital account instantly — no paperwork.

-

Loan approval

Users access savings, payments,and transaction history in real time.

-

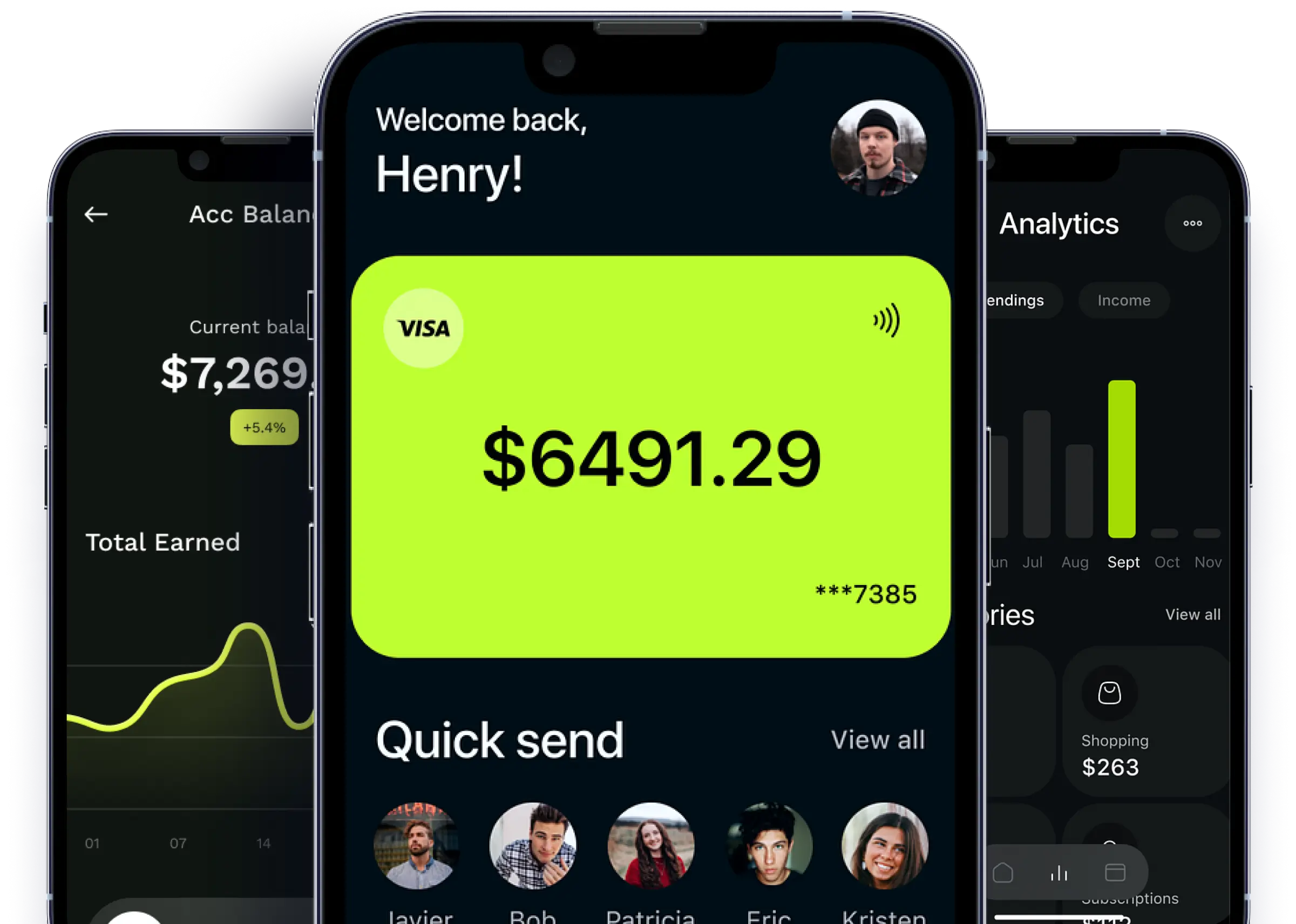

Digital Payments & Transfers

Users access savings, payments, transfers, and transaction history in real time.

SME & Cooperative Banking outcome

Here are six key points that can be associated with a digital Transformation Risk Management Solutions. leader helping Fortune 500 companies on their innovation agenda:

-

Faster and paperless access

-

Improved financial management

-

Strengthened local entrepreneurship

-

Credit for small businesses and farmers

-

Growth planning for SMEs and cooperatives

-

Agricultural productivity