Retail & Digital Banking – Instant, paperless

financial services.

GS-Bank’s Retail & Digital Banking ecosystem is designed to bring secure, paperless, and fast financial access to every individual — from urban citizens to underserved rural communities. Through our advanced mobile and web platforms, customers can open a digital account instantly, manage savings, send and receive payments, pay bills, and access micro-credit without long queues, paperwork, or traditional banking barriers.

Our biometric-enabled onboarding eliminates complex procedures, making banking seamless and inclusive. Every transaction is processed in real time, supported by advanced cybersecurity standards and automated workflows that ensure transparency, reliability, and fraud protection.

Retail & Digital Banking Process

GS-Bank empowers people with simple, ethical, and technology-driven financial services — anytime, anywhere. This is banking built for trust, speed, and financial empowerment across Africa’s digital future.

-

Digital Onboarding

User registers online with biometric or e-signature authentication.

-

Instant Account Creation

Customer receives a verified digital account instantly — no paperwork.

-

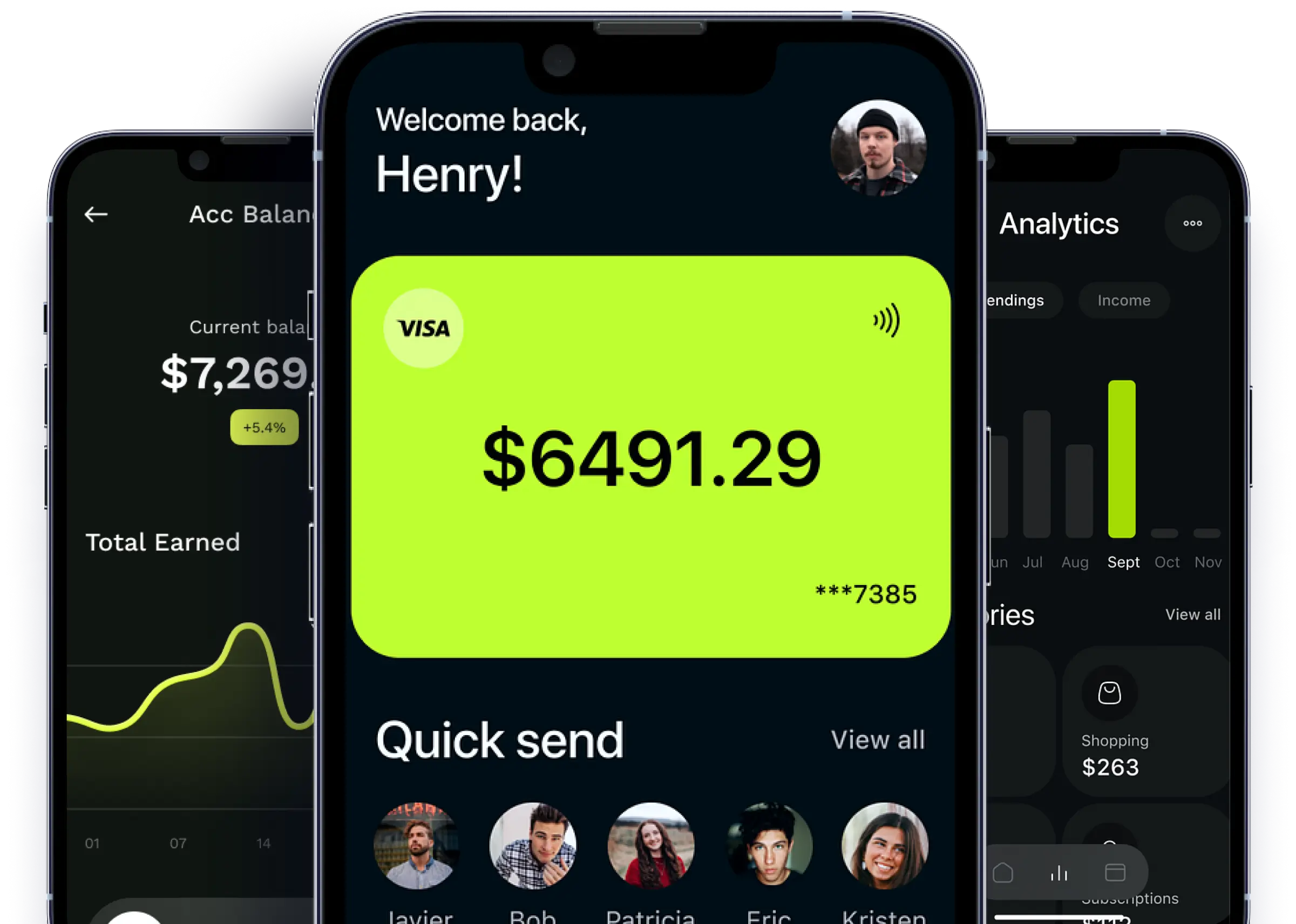

Smart Banking Dashboard

Users access savings, payments,and transaction history in real time.

-

Digital Payments & Transfers

Users access savings, payments, transfers, and transaction history in real time.

Retail & Digital Banking outcome

Here are six key points that can be associated with a digital Transformation Risk Management Solutions. leader helping Fortune 500 companies on their innovation agenda:

-

Customized Risk Assessments

-

Comprehensive Coverage

-

Continuous Monitoring

-

Proactive Strategy Implementation

-

Ensuring Financial Security

-

Wealth for Future Generations