Digital Services & Innovation – Developing fintech

ecosystems,

e-wallets, and digital payment solutions

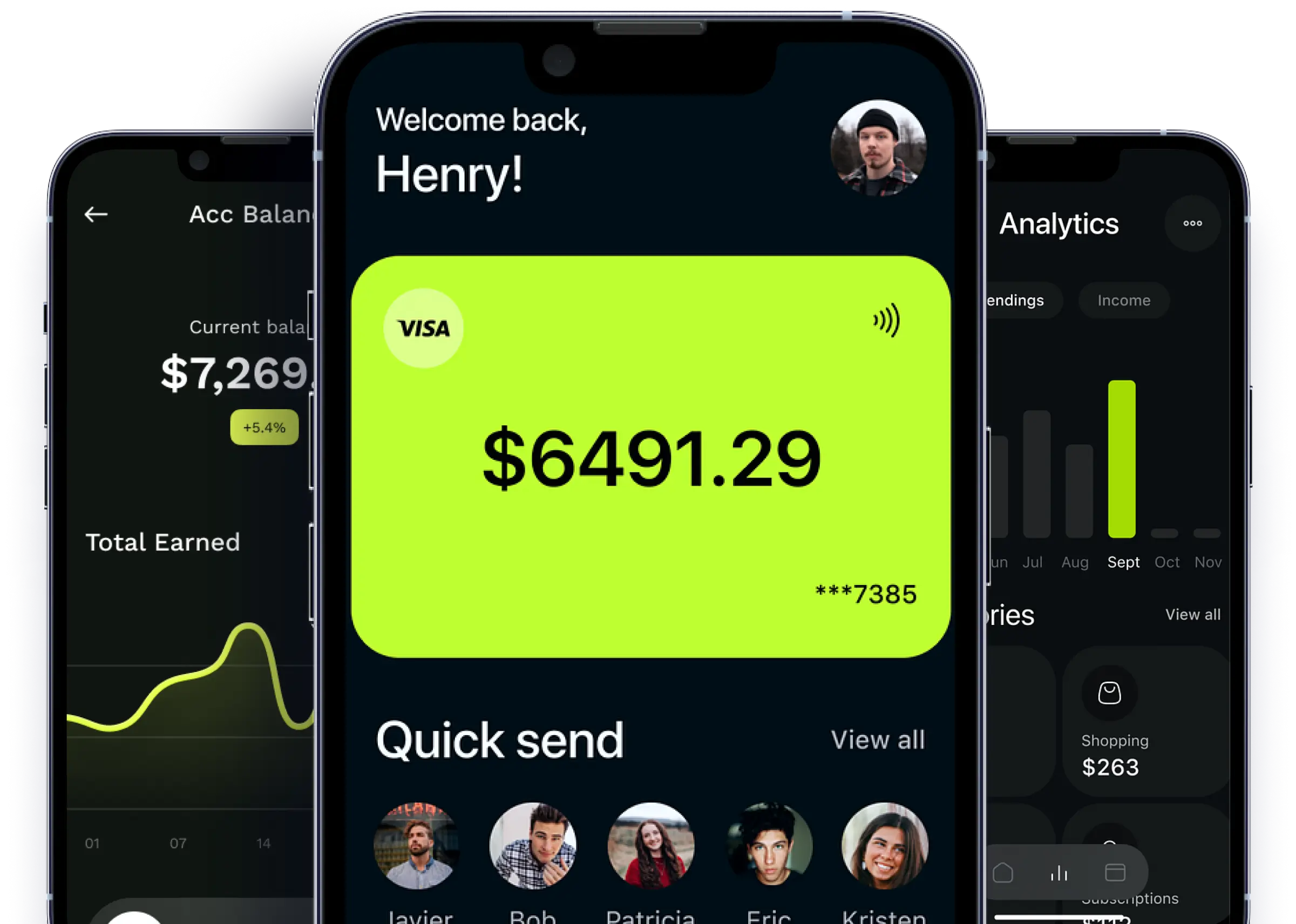

GS Bank’s Digital Services & Innovation division is dedicated to building a modern fintech ecosystem that empowers individuals and businesses with seamless, secure, and smart digital banking solutions. From e-wallets to instant payments, digital onboarding, and AI-driven financial services, the bank promotes a paperless, cashless, and inclusive digital economy.

With a focus on trust, convenience, and innovation, GS Bank accelerates financial access, enabling customers to manage finances anytime, anywhere — efficiently and securely

Digital Services & Innovation Banking Process

With a focus on transparency, responsible banking, and innovation, GS Bank partners with corporations and public institutions to support long-term growth, industrial transformation, and energy security.

-

Customer onboarding & e-KYC

User registers online with biometric or e-signature authentication.

-

Setup of digital wallet

Customer receives a verified digital account instantly — no paperwork.

-

Integration of secure payment

Users access savings, payments,and transaction history in real time.

-

AI-enabled monitoring

Users access savings, payments, transfers, and transaction history in real time.

Digital Services & Innovation Banking outcome

Here are six key points that can be associated with a digital Transformation Risk Management Solutions. leader helping Fortune 500 companies on their innovation agenda:

-

Fully paperless & cashless banking

-

Increased financial inclusion

-

Faster & secure payments for individuals

-

Improved customer satisfaction

-

Enhanced fintech ecosystem through

-

open banking & innovation partnerships